north carolina real estate tax records

You can use this service to pay any of your Property Taxes that are invoiced by our office. The convenience fee for Electronic Check transactions is 275 for each payment less than or equal to 10000 and 15 for each payment greater than 10000.

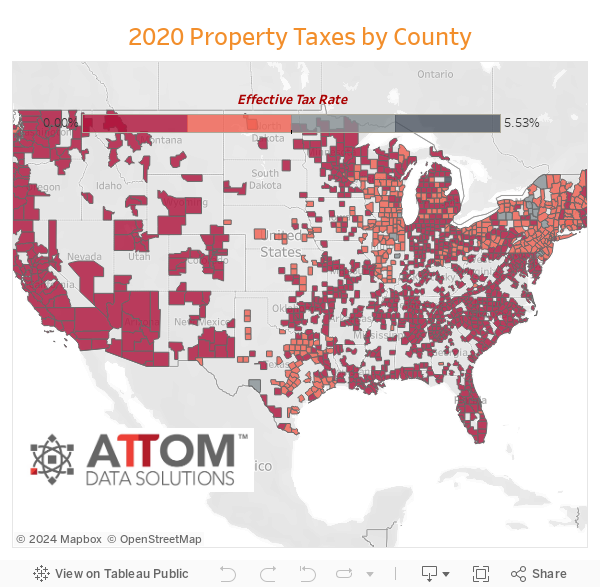

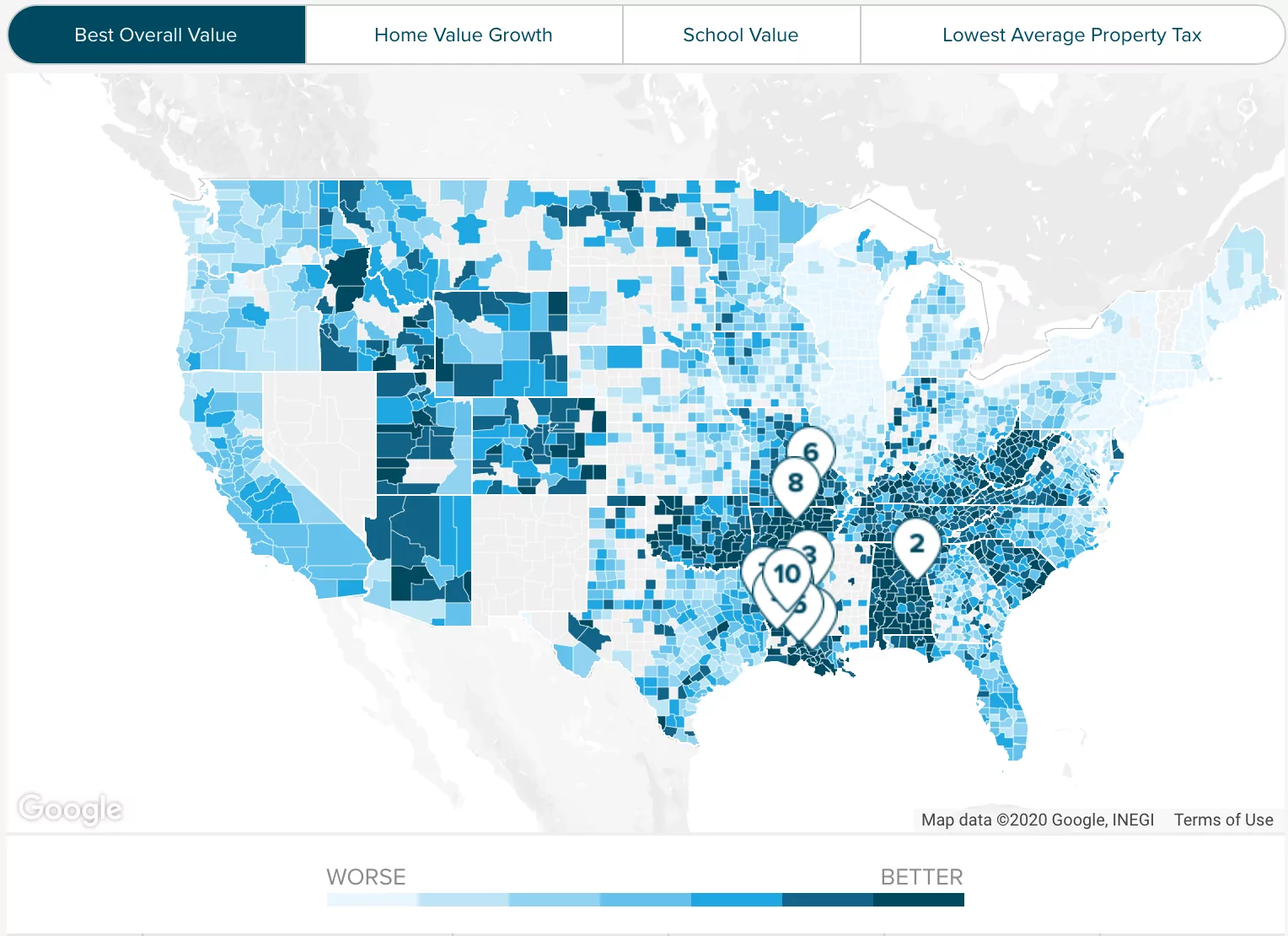

The Average Amount People Pay In Property Taxes In Every Us State

The average total salary of Real Estate Assistants in North Carolina is 35000year based on 30 tax returns from TurboTax customers who reported their occupation as real estate assistants in North Carolina.

. Ad Unsure Of The Value Of Your Property. 745 income tax. This site provides read access to tax record information from Onslow County North Carolina.

Tag and Tax Together Program. Click on a match to see the reports. Tax Administration has added another contactless option for making check or money order tax payments and for submitting tax listings and forms.

336-203-7795 credit debit cards only 3. Box 757 Winston-Salem NC 27102. Monday - Friday 8-5.

Search For Title Tax Pre-Foreclosure Info Today. A North Carolina Property Records Search locates real estate documents related to property in NC. It is the Tax Departments responsibility to assure that all properties are assessed fairly and equitably.

200 N Grove St STE 66. Beginning March 1 st 2022 in accordance with the Ordinance Requiring Certain Documents Conveying Real Property to be presented to the County Tax Assessor Prior to Recordation all documents shall be presented to the Harnett County Tax Department in order to affix information regarding the addresses of Grantors and Grantees along with the parcel number assigned to. 201 North Chestnut Street Winston-Salem NC 27101 Assessor PO.

Wayne County Tax Collector PO. Ad Connect To The People Places In Your Neighborhood Beyond. State Assessed Properties - Public Service Companies.

Tax Office 234 NW Corridor Blvd Jacksonville NC 28540 Phone. The mission of the Craven County Tax Administrator is to perform the legally mandated responsibilities of property assessment tax listing and tax collection in a professional environment where taxpayers are served with courtesy and dignity. Durham County Tax Administration provides online Real Property Records Search.

Public Property Records provide information on land homes and commercial properties including titles property deeds mortgages property. The Real Property Records Search allows the user to obtain ownership information as of January 1 value of improvements and land photo of improvement sales information for the last three 3 years view the tax bill and GIS Mapping information associated with a parcel. Be Your Own Property Detective.

We have placed a new secure outdoor drop box beside the mailboxes in the Judge E. Searches may be in upper or lower case and do not use any punctuation. The department also processes applications for tax relief and tax exemptions that may be granted under State law and maintains up-to-date records of property ownership and tax maps.

That means as you type matches will be displayed below the input box. See Property Records Tax Titles Owner Info More. Payments Please send payments to.

The Address Owner and Subdivision searches autocomplete. Tax Office - Property Records Site. Searches from this page will produce Catawba County Real Estate reports.

The Tax Department lists assesses and collects property taxes on over 24000 real property parcels and more than 2000 businesses and personal property listings in Currituck County. Find All The Record Information You Need Here. Box 757 Winston-Salem NC 27102.

You can also pay by phone by calling 252 360-1033. Maurice Braswell Cumberland County Courthouse back parking lot off Cool Spring and Russell Streets. Chatham County Tax Office.

61 Crimson Laurel Circle Suite 5 Bakersville NC 28705 E-mail. The Local Government Division provides support and services to the counties and municipalities of North Carolina as well as taxpayers concerning taxes collected locally by the counties and municipalities. Search Any Address 2.

201 North Chestnut Street Winston-Salem NC 27101 Assessor PO. This is a tall silver box adjacent to USPS blue mailboxes. Get In-Depth Property Reports Info You May Not Find On Other Sites.

Mail your check or money order to. Henderson County Tax Collector. PO Box 71072 Charlotte NC 28272-1072 No CASH Please The Guilford County Tax Department uses a service called Payit that allows you to pay tax bills online by phone or in person.

To access this information start by performing a search of the property records data by selecting the Search Property Records tab. We also collects the county. Payment drop box located at public North parking lot at courthouse.

1076 income tax records 73000yr. Box 1495 Goldsboro NC 27533. 5150 income tax records 35500yr.

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

North Carolina Estate Tax Everything You Need To Know Smartasset

Ultimate Guide To Understanding South Carolina Property Taxes

South Carolina Vs North Carolina Which Is The Better State Of The Carolinas

Property Taxes By State Quicken Loans

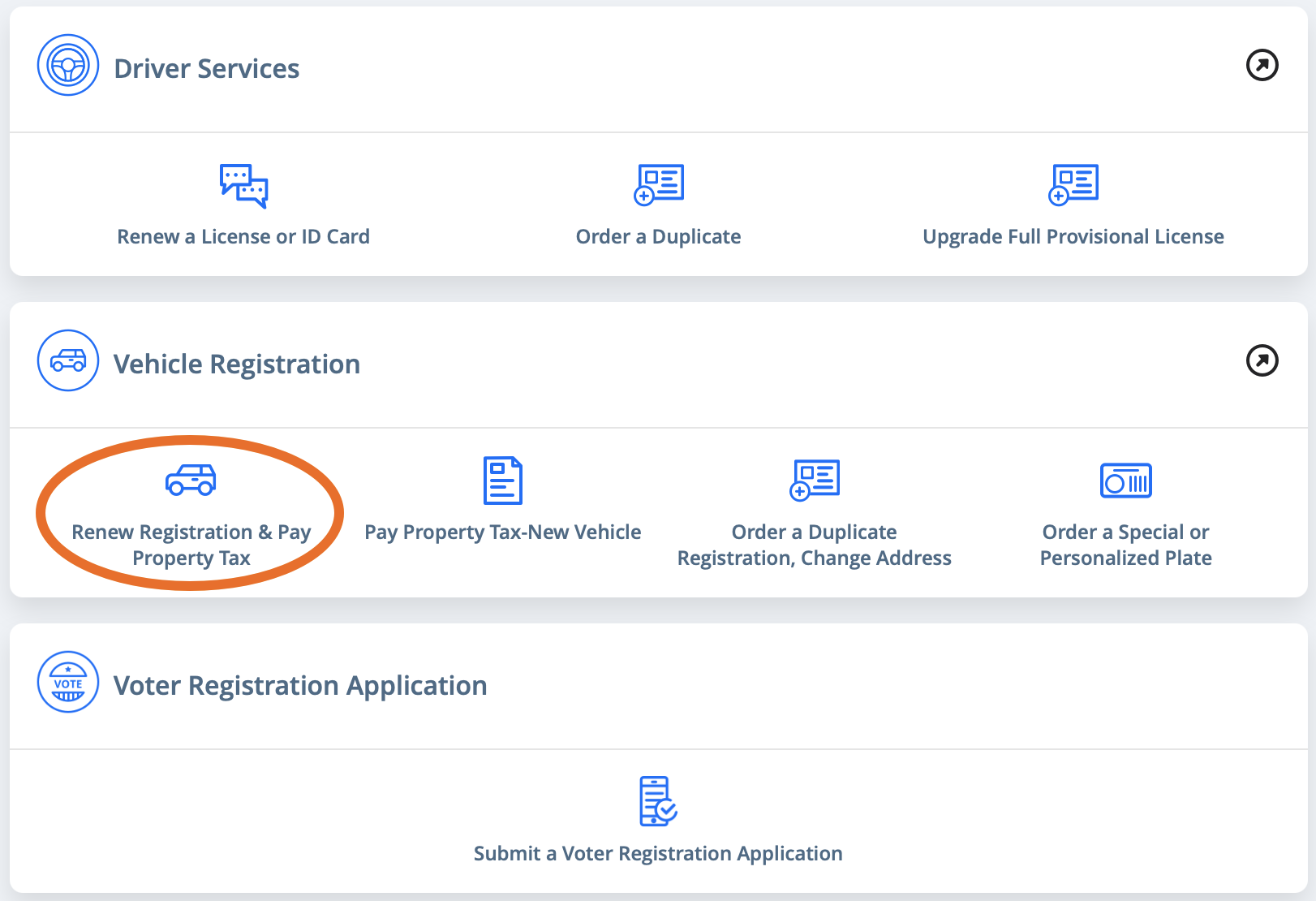

Renew Vehicle Registration And Pay Property Tax Myncdmv

Wake County Nc Property Tax Calculator Smartasset

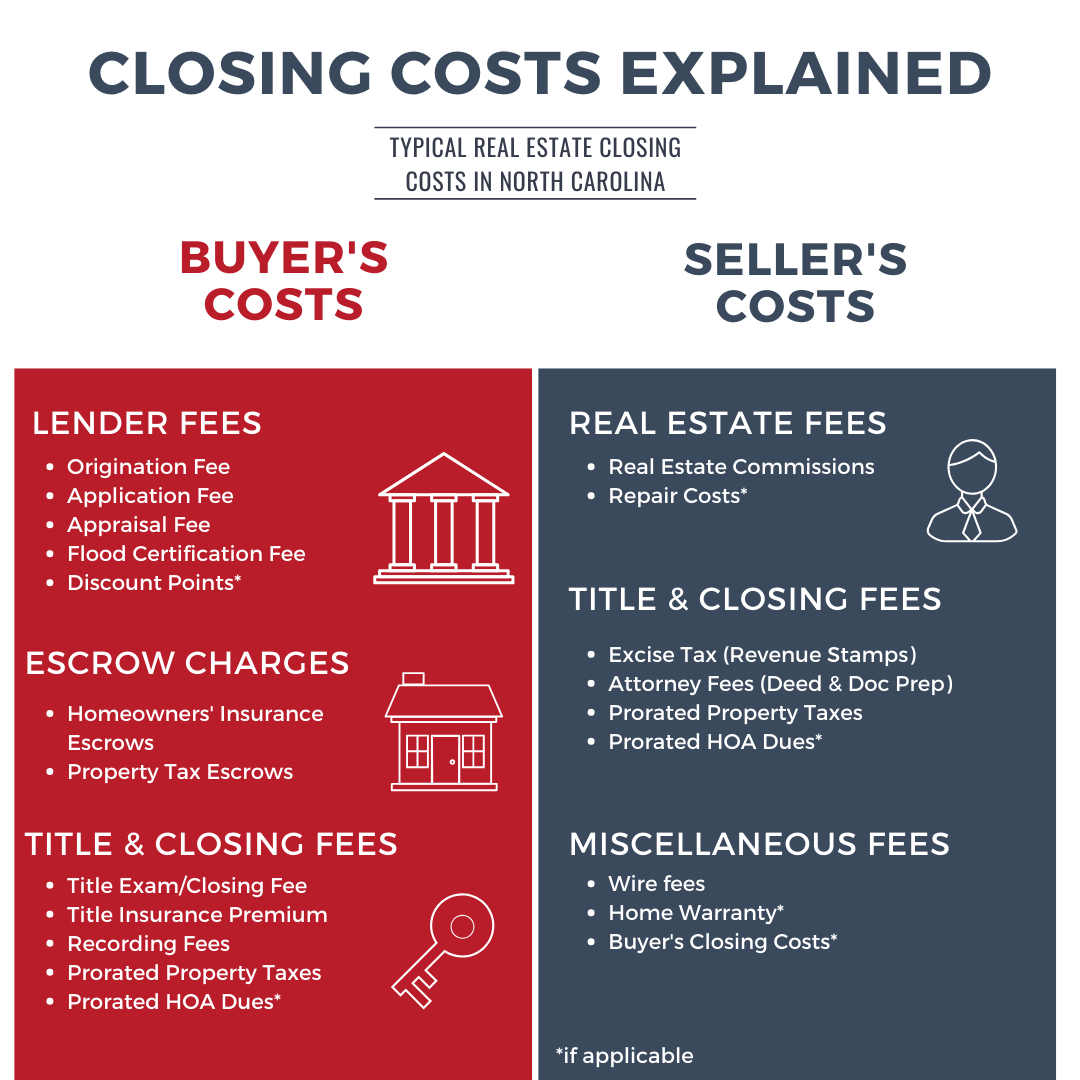

How To Calculate Closing Costs On A Nc Home Real Estate

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

Wake County Nc Property Tax Calculator Smartasset

Wake County Nc Property Tax Calculator Smartasset

Official Ncdmv Tag Tax Together

First Time Buyers Durham County Real Estate Tax Records Property Local Real Estate Durham Wake Top Real Estate Agents Residential Real Estate Nc Real Estate

How High Are Property Taxes In Wilmington North Carolina Mansion Global

North Carolina Nc Car Sales Tax Everything You Need To Know

How To Know When To Appeal Your Property Tax Assessment Bankrate